Preparing teens for life beyond chores and allowances can be tough, but it is important to include Personal Finance for Teens in your list of things to teach your kids before they leave home to help them gain Financial Literacy. By taking the time to build financial literacy for teens, we can set them up for success before it's time for them to leave home and make financial decisions on their own.

As a homeschool mom, my goal is to prepare my children for the future as well as possible. I want to launch my kids well into the world and take my role to prepare them to leave home very seriously. One very important part of this is to prepare them with enough financial literacy to be a fully functioning adult when they leave home.

Disclosure: This is a sponsored post and I was compensated for my time to write this post. I received the product for free for review. All opinions are my own.

What is Financial Literacy?

Simply put, financial literacy is the knowledge needed to make important financial decisions. Having financial literacy means someone has the ability to weigh the pros and cons of a money decision and confidently choose what to do in the areas of debt, budgeting, saving, borrowing, and investing.

Why is Building Financial Literacy for Teens Important?

Teaching teens about personal finance and helping them build financial literacy early can help set them up for success in adulthood. And, while it may seem a bit dramatic to think about, teaching your kids about personal finance and building their financial literacy can directly impact your family's future generations.

If you think about it, everything you teach or don't teach your kids, could eventually impact your grandchildren in some way. Which leads to the question: What type of financial literacy legacy do you want to leave?

Do you want to raise kids that can make wise investments, support themselves, and not dig themselves deep into debt? Then, I'd say teaching personal finance is a priority.

Ways to Teach Personal Finance for Teens to Build Financial Literacy

There are so many components to building personal finance skills for teens, but there are a few really simple things you can do to get started encouraging financial literacy and independence with some of the money skills teens will need the most in their day-to-day lives.

Put teens in charge of their money

If you are holding onto money for your teen, it's time to start letting them be in charge of their cash. So many money lessons are abstract until teens get cash in their hands and start to notice that their money is dwindling quickly. It's totally appropriate to start making them responsible for certain parts of their spending. You don't always have to pay for everything, mom.

Help teens open a checking and savings account

I prefer to start my kids out with cash first because it's harder to grasp spending habits with a debit card or writing a check, but eventually it will be time to move past the piggy bank phase and teach your teen how to keep up with a bank account. This includes teaching them to reconcile their account with the monthly bank statements, learning how to write checks, and not spending more than what is available in their account just because they have a debit card at their fingertips.

Let teens practice budgeting in smaller situations

Teaching teens how to budget and letting them practice in smaller situations is a great way to help them gain the confidence to budget in larger situations. For example, let them help plan out meals and groceries for the week. Or, assign a specific night each week that they are responsible for a meal from start to finish--planning, budgeting, shopping for ingredients, cooking, and cleaning up. Or, give them a certain amount of money and let them plan out a birthday party. There are lots of smaller situations that teens can practice budgeting skills, you just have to get creative and give them a chance to practice.

Teach teens how to file taxes

If your teen is employed, then they will need to file taxes. You can teach them how to file taxes using the old school paper tax forms, but with so many people going digital and filing with computer tax programs these days, I think it's totally appropriate to teach teens how to file them digitally, too. Computer tax programs still ask them to find certain boxes and fill in the amounts just like the paper forms and the end result is ultimately still the same.

If your teen isn't employed yet, let them sit with you while you work on your taxes. They can help you find the correct boxes and fill in the amounts on your taxes to gain the experience for the future.

Discuss money with your teens

This one seems like a no-brainer, but somewhere along the lines discussing the family financial situation became a taboo topic for some families. While you don't have to invite your kids to every single money discussion you and your spouse have, I think it's important to openly talk about money with your teen in your daily lives. For example, if your family has to decline an invitation to go somewhere due to the budget, talk to them and explain how you made that decision. Or, if you are comparing a large item to purchase, talk through your decision making process. Opening up the communication lines about money will only benefit you in the long run if your teen ever gets into money trouble down the road and needs to come to you for help.

Use a personal finance curriculum for teens to teach financial literacy

In our homeschool, personal finance is a required course to graduate. However, I think I would teach personal finance on my own whether it was required or not because it's such an important topic for teens.

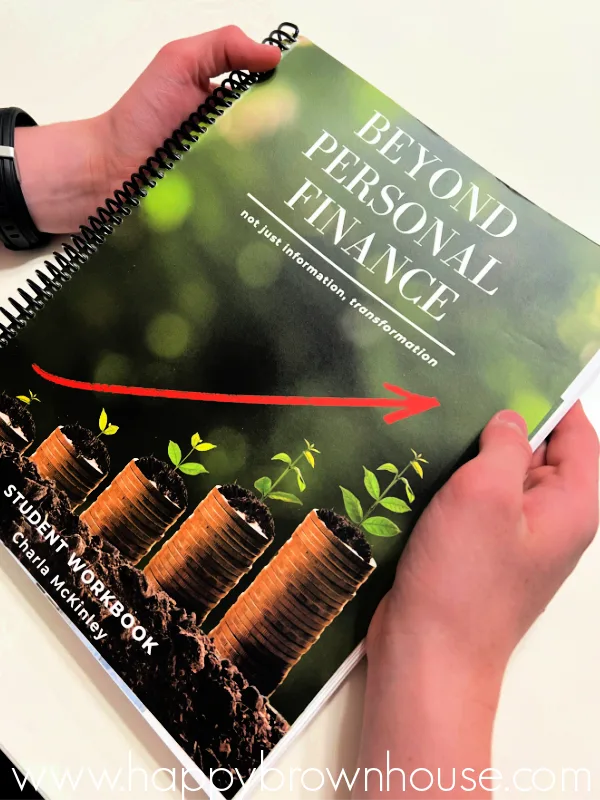

There are many personal finance curriculums to choose from, but I can personally recommend Beyond Personal Finance, an experienced-based course covering a wide range of real-life money situations.

Beyond Personal Finance Curriculum

This self-paced financial literacy curriculum for teens is a great one-semester elective that will cover all of the basics of personal finance as well as cover deeper topics to help your high school student be prepared for every major financial milestone they might encounter from college to retirement.

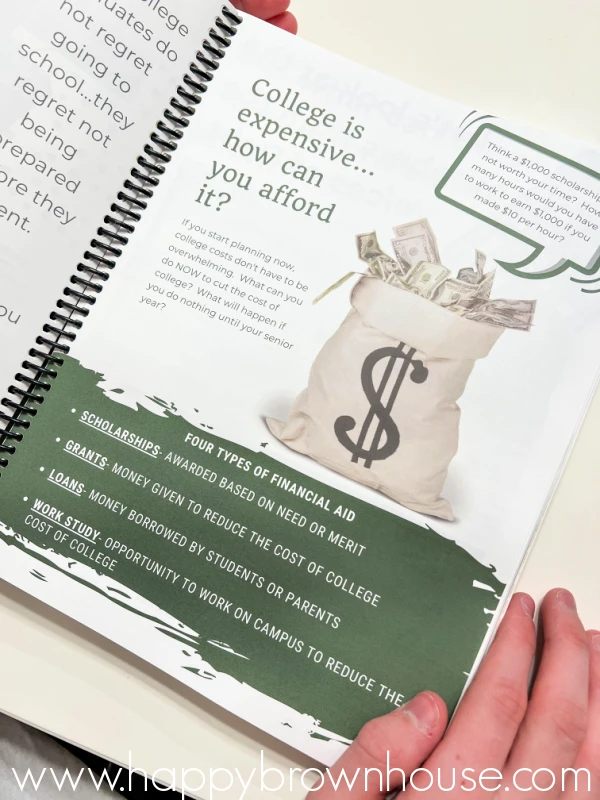

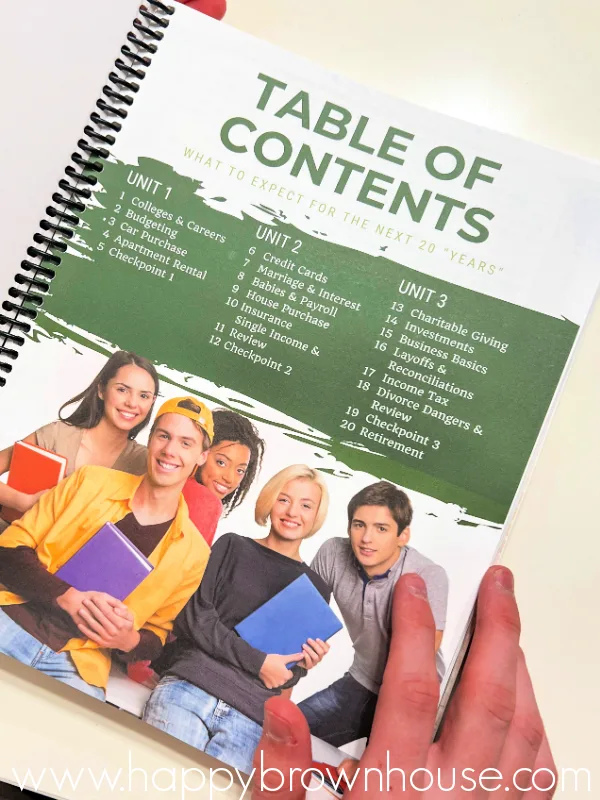

Divided into 3 units, this financial literacy course for teens includes a total of 20 lessons about different money-related topics and gives your teen the opportunity to think about how they will handle common real-world situations including:

- College & career choices

- Purchasing a car

- Renting an apartment

- Buying a home

- Marriage & family

- Retirement

- and more!

If you are looking to have more than four teens take this personal finance course, then you should check out the group option from Beyond Personal Finance. It's perfect for a co-op situation!

Using both video lessons and a workbook, Beyond Personal Finance will walk your teen through an interactive financial "choose your own adventure" with the real life decisions they will need to make as they begin their adult lives and show them just how those decisions will affect their future.